| « The Arab Revolt in Tunisia and Egypt | El Salvador's Sweatshop Economy » |

The "Recovery" - - Just Don't Eat, Heat Your Home, or Buy Clothing

We still don’t even know if Fed officials actually believe the ridiculous things they say, or whether they are merely acting stupid to hide the fact that they have created a world in which financial prudence is punished, those who save are forced to subsidize those who speculate, and people around the world are rioting just so someone will notice that they can no longer afford to feed themselves or their family.

By definition, an unhealthy financial market is one in which prices move daily in one direction only, for an extended period of time. Markets without corrections, without the give and take of investors having different opinions about the future, are prone to sudden shocks. This is precisely the situation that has afflicted US stock markets since last July, when investors began to entertain the unanimous opinion that the stock market can only go up because the Federal Reserve will never allow it to correct. And why shouldn’t they think this way, when Fed Chairman Ben Bernanke keeps repeating that a rising stock market with low volatility is a monetary objective of the central bank? He said so again yesterday during his speech and follow-up press conference at the National Press Club:

... the Federal Reserve's securities purchases have been effective at easing financial conditions...equity prices have risen significantly, volatility in the equity market has fallen, corporate bond spreads have narrowed, and inflation compensation as measured in the market for inflation-indexed securities has risen from low to more normal levels...

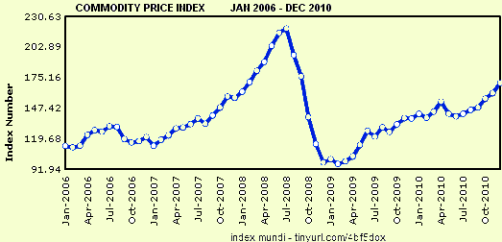

Bernanke was referring to the “beneficial” consequences of his quantitative easing program – QE2 – in which he is buying $600 billion in Treasury securities through June. Notice how he also touted the pick-up in inflation to “more normal levels.” Really? What central bank chairman can say with a straight face that the commodity price increases we just saw in the last month were normal: wheat up 6%, sugar up 6%, corn up 8%, rice up 10%, hogs up 10%, and cotton up 17%? And this was just January. Here we are four days into February and commodity price increases are accelerating. Do you think the market might have noticed that one of the Fed governors said the Fed is now actively discussing QE3?

What Could the Fed Possibly Have to Do with Riots in Egypt?

When asked about these increases in commodity prices, Bernanke said they weren’t his fault. Emerging markets economies are growing so quickly that demand for basic foodstuffs and other staples is outpacing supply. Besides, unusual weather conditions like droughts in Russia and floods in Australia are diminishing crop yields. This is all true, but the natural disaster story only works for some commodities for a specific period in time. It doesn’t explain why so many commodities are in a speculative fury, and why the speculation began on the very day Ben Bernanke announced the Fed was considering QE2. Nor is it a coincidence that stock markets began to rally in the US on that same day as well. We may be expecting too much for a trained economist such as Ben Bernanke to understand this, but if the central bank says it has $600 billion it is going to inject into the markets, and it wants to see the stock market go up, and it wants to see commodity prices go up, and it will guarantee that prices won’t go down, investors and speculators are going to buy stocks and commodities.

So the question increasingly facing the markets is whether Ben Bernanke and his fellow governors are being naïve, or disingenuous, or just mentally challenged when they say rising asset prices have nothing to do with their QE2 program. You could see the business reporters scratching their heads in wonder when Bernanke replied to a question about his responsibility for the riots in Egypt by saying the Fed had nothing to do with this because Egyptians buy food not in dollars, but in Egyptian pounds. Doesn’t he know that the Egyptian pound is pegged to the dollar, and commodity price increases feed directly into their economy because almost all commodities are priced in dollars?

The good news about this press conference is that at least the business and financial press are starting to understand that raging commodity prices are both closely associated with the Fed’s quantitative easing programs, and that these price increases are the one constant theme in anti-government protests from Algeria to Tunisia to Egypt and elsewhere. Egyptians have taken to the streets for reasons beyond just the cost of bread and coffee and sugar, but this has in every one of these countries been the spark that ignited mass demonstrations, because the cost of food constitutes 40% of the monthly income in most developing economies (compared to 13% in the West).

The press has also caught on to the fact that the Fed way of thinking about inflation is very strange and has nothing to do with the experience facing someone on the street. The Fed looks at “core inflation”, which strips out the volatile components of food and energy, and on this basis inflation is benign. Bernanke is not old enough to remember this was the exact sort of silliness that permeated the Fed in the 1970s during a period of high inflation. The Fed kept stripping out more and more components of the consumer price index that were too volatile and masking the trend in core inflation, which of course always wound up to be stable by definition.

As the saying goes, as long as you don’t eat, don’t drive anywhere, and don’t heat your home, inflation is just fine. Just as you should ignore the fact that Brent crude oil is now priced at $104/bbl, in response to fears about closure of the Suez Canal, and pretend that these price increases are the result of solid economic growth, as Bernanke has said. This is strangely reminiscent of the ridiculous argument both Greenspan and Bernanke used to make before the crash of 2007, when they said US fiscal and trade deficits were the result of a “savings glut” in China and India. In American terms, US problems are always somebody else’s fault.

But Wait! Doesn’t the Economic Recovery Have “Legs”?

What about all those excellent economic results we’ve been seeing in the past few months? The headlines suggest the economic recovery finally “has legs”, and job growth is just around the corner. The problem occurs when you read deeper into the data. The 3% growth rate in GDP was accomplished partly by inventory buildup (especially in autos), partly by record levels of government stimulus, and partly by inflationary increases in the economy. People forget that through the stagflation of the 1970s, GDP growth often exceeded 5% because prices were going up at least by that amount. The dry rot occurred underneath the surface, as savings decreased and profits fell as well.

The same thing is beginning to happen today. Companies are recording strong revenue growth, but they can only grow earnings by cost cutting. We’ve seen many companies this quarter announce “margin compression”, meaning they are paying more for raw materials and basic goods, but they can’t raise their prices high enough to compensate without jeopardizing sales. So revenue growth, strong as it is, isn’t strong enough to offset the rising cost of goods sold. You can see this also in the service and manufacturing monthly performance reports, which headline growth in these two sectors at levels last seen around 2005. Dig deeper, however, and you find “prices paid” by companies are growing at an even faster rate.

Choose Your Poison: Stagflation, Inflation, or Deflation

This may be an economic recovery that has “found legs”, but they are the wobbly legs of inflationary growth, not sustainable, healthy growth. This type of economic recovery leaves the United States, and the global economy for that matter, with three possible paths: stagflation, inflation, or deflation.

Stagflation would be the best possible outcome. Unemployment would remain high – US unemployment is down to 9.0% as of this morning’s report, but much of the decrease stems from dispirited job seekers leaving the labor force. Inflation would also remain high, courtesy of the Fed’s attempt to artificially create demand through inflation (something that has never been done successfully before). The economy would suffer through a roller coaster ride of anemic recovery followed by a recession, in a repetitive cycle.

Inflation, or even hyperinflation given the gargantuan amounts of monetary stimulus being placed into the economy, is another possibility. This is what the market seems to fear the most, and you can bet on this outcome if you believe that there is no group of people or force that can stop Ben Bernanke and the governors of the Federal Reserve. So far that has been a good bet. The central bank operates without external controls or oversight of any sort. Congress complains but does nothing to rein in the Fed – and in some respects this is logical because the Fed is enabling both Congress and the Administration’s enormous propensity to borrow and spend since the Fed is buying up most of the debt instantaneously. The new Congress is filled with Tea Party types that supposedly are shocked and appalled at deficit spending. We shall see if these people have the courage to stand up to the Fed, and if they do whether that is enough to put a stop to the quantitative easing programs. If not, we are in for a potentially serious bout of uncontrollable inflation that can only be stopped with painfully high interest rates, and the replacement of Bernanke by someone like Volcker willing to impose such pain.

This, however, is ultimately no different than shutting down the economy now and liquidating the debt overhang that got us into these problems in the first place, and have been made much worse under Bush and Obama’s bank bailout programs. Liquidating debt on a large scale is deflationary, and this is option number three if done right away, meaning QE2 comes to an end and Washington really does start to do something about deficit spending. The economic contraction will be severe, no doubt, but it will be less severe than if the US continued on path number two, which ultimately can only be resolved with a greater deflationary shock to the economy.

Option three may not be as sure a bet as option number two, because a withdrawal of quantitative easing represents immediate pain for the banks that constitute Ben Bernanke’s principal constituency. Every day the Fed buys up Treasuries under the QE2 program is a day that the banks as primary dealers in government securities are guaranteed fee income of tens of millions of dollars. It’s no wonder that bankers bonuses for 2010 were at record levels. If there is one thing we’ve learned in this financial crisis, now into its fourth year, it is never count out the ability of Wall Street and the banks to find their way to the greatest possible profit. This is priority number one for the financial sector, and because the financial sector has captured the hearts and minds of the Fed, it is the first priority for US monetary policy.

Who Says You Can’t Fight the Fed?

If the US can’t constrain its own central bank from ruining the nation and the global economy, it will be up to the financial markets to punish the US in order to put a stop to the madness. This is already happening in at least two ways. For one, long term interest rates on Treasury securities have headed up along with the stock market and commodities prices ever since Ben Bernanke began publicly discussing QE2. The original stated purpose of QE2 was to keep long term interest rates lower, but this has been such a pronounced failure that Bernanke didn’t even mention it in his press conference this week.

The second source of pressure is jaw-boning. Some of this we saw yesterday when reporters repeatedly challenged Bernanke on his assumptions and claims, but since Bernanke only gives these press conferences every two years, we will have to wait until 2013 for the Chairman to be publicly tested on his policies. The Fed is, however, losing ground globally. Not a week goes by when some Chinese official doesn’t castigate the US for its destructive monetary policies, and this week Mervyn King, Governor of the Bank of England, gave an extraordinary speech where he took to task “other central banks” for perpetuating and initiating asset bubbles. King made it very clear to the British public that there is nothing the central bank can do to forestall the decline in living standards that is the result of liquidating bad debts in the economy. He also apologized to all the savers and others who behaved “prudently”, and acknowledged that zero interest rates were a direct transfer from the prudent to the bankers who blew up the economy in the first place.

Such honesty is rare in central bankers, and non-existent at the Fed. We still don’t even know if Fed officials actually believe the ridiculous things they say, or whether they are merely acting stupid to hide the fact that they have created a world in which financial prudence is punished, those who save are forced to subsidize those who speculate, and people around the world are rioting just so someone will notice that they can no longer afford to feed themselves or their family.

First published in The Agonist.