| « The Bush Family's Project Hammer | In tea party address, Palin stokes the anti-rights fire » |

Cuomo Takes on The Money Party

Bank of America Looks Like First of Many

"This merger (Bank of America and Merrill Lynch) is a classic example of how the actions of our nation’s largest financial institutions led to the near-collapse of our financial system," said Attorney General Cuomo. "Bank of America, through its top management, engaged in a concerted effort to deceive shareholders and American taxpayers at large. This was an arrogant scheme hatched by the bank’s top executives who believed they could play by their own set of rules. In the end, they committed an enormous fraud and American taxpayers ended up paying billions for Bank of America’s misdeeds." (Image)

New York State Attorney General Andrew Cuomo

Andrew Cuomo's complaint filed in the New York Supreme Court, County of New York against the Bank of America and two former top executives has the potential to push that too big to fail entity off the edge of a very steep cliff. The charges of massive fraud are based on a compelling and exhaustive filing on February 4.

A trial will likely involve testimony by the current Bank of America CEO and President Brian Moynihan against defendants Kenneth Lewis, the bank's former CEO and board chairman, former chief financial officer (CFO) Joseph L. Price, and the bank itself. Price is currently in charge of BofA's credit card division.

The complaint charges fraud before, during and after the bank's merger with struggling brokerage firm Merrill Lynch in late 2008. The fraud cost bank shareholders and citizens billions of dollars. This is the first major case brought against our nation's largest financial institutions. These are the same financial institutions and executives that nearly destroyed the economy.

Cuomo's press release states clearly that Lewis and the bank are examples of a much larger problem. It appears to be a leading indicator of future actions by the New York attorney general. Why else would Cuomo have generalized about institutions (plural) in his statement about this particular case?

If Cuomo succeeds in taking down one of the toughest guys on the block, he'll make a point to the rest of the crew: you're next, get ready to cooperate. Many of the key perpetrators are located in Cuomo's jurisdiction, although Bank of America (BofA) is headquartered in Charlotte, North Carolina. Clearly, there are others in line for some New York style law and order.

Cuomo is joined in this action by Niel Barofsky, Special Inspector General for the federal government's Troubled Asset Relief Program (TARP). TARP provides the billions in bailouts to bogus bankers and corporations. There's a credit line of $23.7 trillion should it be needed for even more bailouts. Ever wonder why you can't get a loan? They've taken all the money.

Charges and remedies

The bank and the two named executives are charged with failing to inform the bank's board of directors and shareholders of the major red ink on Merrill Lynch's books prior to the merger. CEO Lewis, CFO Price, and other BofA officers and professionals chose to hide $16 billion of Merrill Lynch known pre tax losses prior to board approval. That's fraud, plain and simple. Complaint filed by New York Attorney General, Feb 4, 2009

The complaint also charges that the same parties with strong arming the federal government for $20 billion to cover Merrill's debt by threatening to back out of the merger if the money wasn't forthcoming. Then Secretary of the Treasury Henry Paulson and Fed Chairman Ben Bernanke had encouraged BofA to acquire Merrill, apparently without a rider that BofA would get billions in the process to cover their fraudulent business practices.

The lawsuit seeks two overriding remedies. The two named defendants and the entire Bank of America are enjoined from "any conduct, conspiracy, contract, or agreement, and from adopting or following any practice, plan, program, scheme, artifice or device similar to, or having a purpose and effect similar to, the conduct complained of above."

In addition, the defendants and the bank are to "disgorge all gains, pay all penalties and pay all restitution and damages caused, directly or indirectly, by the fraudulent and deceptive acts complained of herein"

These and the other remedies promise a degree of justice and, quite frankly retribution for the mess caused by the defendants. An unnamed and unintended remedy could be serious damage to the good will value of the Bank of America. The spectacle of a conviction of the bank and a former CEO and current division head for fraud would have a devastating effect on public confidence. Too big to fail may be a notion upended once and for all by a guilty verdict.

Witness Lineup – It's Bank of America versus Bank of America

Andrew Caffrey and Todd Wallach of the Boston Globe, hinted that Bank of America president and CEO, Brian T. Moynihan will be a key witness for the prosecution. The Globe article notes that the current BofA chief, "who was involved in negotiations (for the Merrill acquisition) as the bank’s general counsel, was not charged." Later in the same article, they quote Cuomo as saying, Moynihan, "has been candid with our office with respect to the roles he played after becoming general counsel."

Put simply, Moynihan was central to the merger, knew about the fraud, participated in it, but didn't blow the whistle. All of that is established in Cuomo's complaint. He cooperated with Cuomo and wasn't indicted. His name will be at the top of the attorney general's witness list, no doubt.

As if that's not bad enough for the bank, defendant Joseph L. Price, former CFO, is currently heading up Bank of America's credit card division.

Should Moynihan testify, we'll see BofA's current CEO helping Cuomo convict his predecessor of fraud. Moynihan's testimony will also argue for a conviction of his current head of credit card operations. Since Bank of America is charged, we'll also see its current CEO plus the “Relevant Parties” described in the complaint testifying that the corporation was also guilty of fraud. Many of the 35 Relevant Parties named are current or former BofA executives or board members.

Other key witnesses may include Federal Reserve Chairman Ben Barnanke and former Treasury Secretary and TARP architect Henry Paulson, They encouraged the Bank of America - Merrill Lynch merger as part of their efforts to prevent an alleged financial meltdown at the end of the Bush administration..

Charlie Gasparino of the Daily Beast reports that the defense counsel, former U.S. Attorney Mary Jo White, wants the case dismissed. If not, Gasparino says that "one person close to the defense” claims that White will call Paulson and Bernanke to testify. Cuomo has the facts and obviously believes Paulson and Bernanke on the sequence of events leading to these charges. Absent a “Perry Mason” moment by the defense, their testimony holds no surprises or benefits for the defendants. Mary Jo White has little or nothing at this point other than bluster.

Justice for the people?

It's been ten years since Congress and President Clinton freed Wall Street and the major banks to open a big casino on Wall Street. That resulted in ruinous schemes like the real estate bubble. It's been five years since Alan Greenspan told citizens to get an adjustable rate mortgage, cash out the equity in their homes, and jump into the stock market. It's been over a year since Wall Street and the big banks nearly ruined the economy, cost citizens jobs, savings, retirements, and countless other hard earned gains through a variety of no-win schemes sold as solid investments.

Nothing of any importance has been done to regulate the financial industry since the bailouts. Prior to the Cuomo-Barofsky charges, there have been no major cases brought against the perpetrators of our current troubles.

Hopefully, New York Attorney General Andrew Cuomo started what will become an era of accountability for those at the very top. This should be about more than just one case. It's an example of top down accountability.

May the bank, Mr. Lewis, and Mr. Price have the speediest of trials and the absolute maximum penalties should they be found guilty.

They knew exactly what they were doing every step of the way.

END

This article may be reproduced in full or part with attribution of authorship and a link to this article.

Next Monday - Cuomo's Lock Down – The Case in Detail

Complaint filed by New York Attorney General, Feb 4, 2009

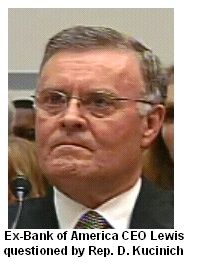

Rep. Kucinich Grills Ken Lewis on Fed Emails, June 11, 2009

Rep. Cummings Questions Brian Moynihan Regarding the BofA/Merrill Lynch Merger, Nov 17, 2009

No feedback yet